Hey Krugman: remember the Laffer Curve…?

Nov 21, 2012

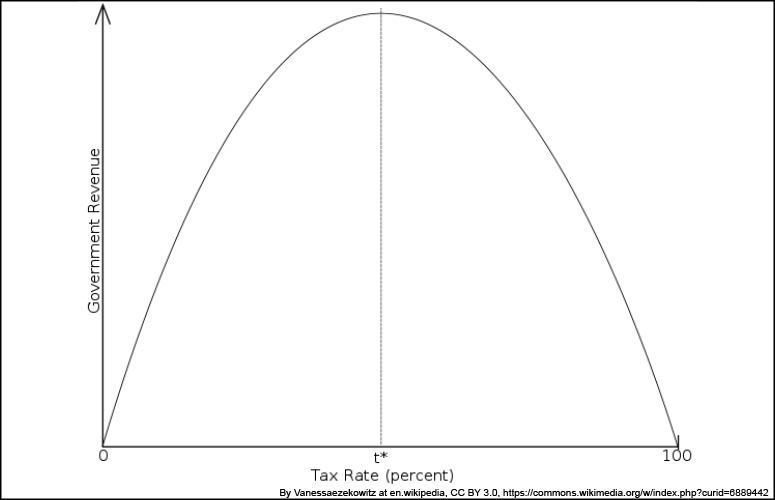

In his most recent, and highly visible, op-ed, Paul Krugman appears to pine for days when the US had a 91 percent top marginal income tax rate. Unfortunately, as Mickey Kaus points out here, the notion that such a high income tax rate will bring in the extra revenue Krugman seems to expect is deeply flawed. In fact, it seems Krugman has forgotten the simple wisdom associated with the Laffer Curve.

As Kaus states,

If the rich actually paid the high income tax rates of the 1950s–as opposed to wasting a lot of society’s energy finding loopholes and evading them–then the Simpson-Bowles argument for low rates/fewer loopholes would make less sense. It might even seem to be a conspiracy to let the super-rich off the midcentury redistributionist hook. But the super-rich didn’t pay those rates.

This is a key concept often missed by those arguing for higher taxes. Even in the era when there were extremely high marginal rates, lower capital gains tax rates as well as a myriad of tax exemptions and credits led to far lower effective rates. In other words, those rates really didn’t bring in the revenue that, superficially, one might have expected, rather, they simply led to ever-more creative tax planning and avoidance.

This is the elementary idea exemplified by the famous Laffer Curve.

What this indicates is that rather than hiking rates and then offering ways to make the effective rates lower so that revenue doesn’t decline, we should shift our focus to making the tax code simpler, more transparent and flatter.

As Dr. Arthur Laffer himself puts it in the 2011 “Rich States, Poor States” report issued by the American Legislative Exchange Council, “An economically efficient tax system has a sensible, broad tax base and a low tax rate.”

A tax code that meets this criterion would still produce reasonable revenue and, even better, would be less distorting of economic activity by allowing people to make economic decisions based on supply, demand, and market principles as opposed to decisions based on preferential (or prejudicial) tax treatment.

This is what lies at the core of the Buckeye Institute’s efforts in the past regarding the examination and closing of so-called “tax loopholes.”

We should not be hiking taxes or adding complexity to an already complex tax code at both the federal and state levels. Prosperity will be easier to pursue when we embrace rational tax policy and not the disingenuous dreams of those like Krugman who want us to pursue chimeras of fairness in the face of reality.