Big Government Spending Not Requisite for Economic Growth

May 01, 2012

By Adam Schwiebert

At the Buckeye Institute, we believe that economic prosperity is best achieved when the size and scope of government is limited. Smaller government means lower taxes, less bureaucracy and more individual freedom, which in turn enable the real engines of job growth—entrepreneurs and private business—to grow and succeed, and our communities to flourish. Therefore, to stimulate economic growth, states should look not for greater government intervention but to instead create vibrant pro-growth business climates.

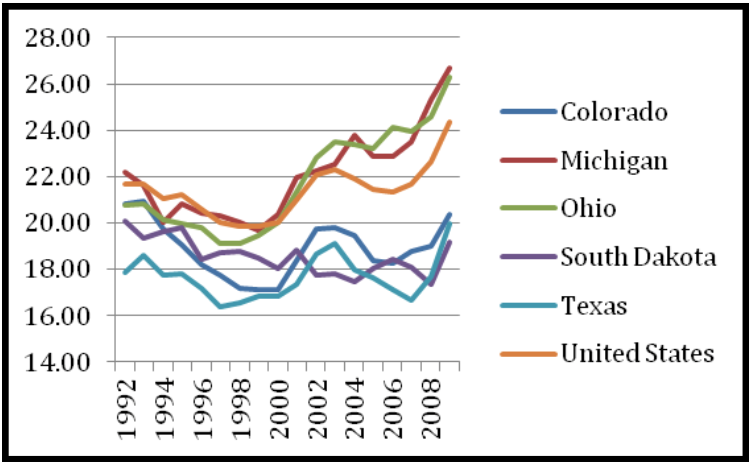

To measure how effectively states restrain the size of their governments relative to their tax bases, we utilize the popular “spending burden” research model. The spending burden model measures state and local government spending as a percentage of each state’s private sector gross domestic product. The lower the percentage, the less resources government must remove from the private economy through taxes. The results in Chart 1 below confirm what we largely know already: States that spend heavily, such as Ohio and Michigan, have not witnessed the strong economic growth that low spending states have experienced.

Chart 1: State and Local Spending as a Percentage of Private Sector GDP (1992-2009)

Sources: Bureau of Economic Analysis and author’s calculations

Spending burdens rise for two reasons: Either the private sector economy decreases relative to government spending or government spending exceeds private sector growth. Both are true for Ohio.

Over the past two decades, government spending in Ohio has grown far faster than private sector growth. From 1990 to 2009, Ohio state spending outpaced inflation by 41 percent.[1] During that same time, per capita income growth in Ohio averaged only 3.4 percent, tying for 6th lowest in the nation. The end result was a spending burden that grew from 20.74 percent of Ohio’s private sector economy in 1992 to 26.30 percent in 2009.

Ohio is not alone. Michigan spent heavily over the past two decades and achieved underwhelming economic results. Like Ohio, its spending burden exceeded the national average and reached nearly 27 percent of its private sector economy by 2009. When government grows faster than its tax base, it becomes more burdensome to job creation and only further stifles economic growth.

Other states have followed a different, more prosperous course. Texas, South Dakota, and Colorado are three states that have done a far better job at limiting government spending to the growth rate of the private sector. As a result, the spending burdens for each of these states is at or below 20 percent of their private sector economies.

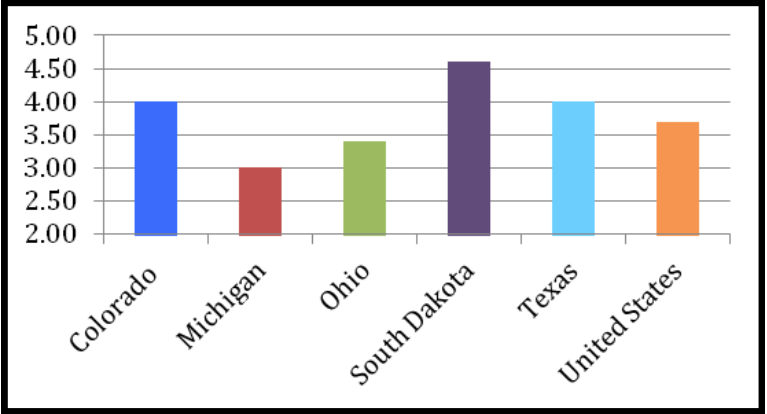

Despite these restrained spending levels, economic growth has flourished in these states over the past two decades. Per capita income growth averaged 4.0, 4.6, and 4.0 percent in Texas, South Dakota and Colorado, respectively, from 1992 to 2009—far outpacing the anemic growth of Ohio and Michigan.

Chart 2: Average Per Capita Person Income Growth (1992-2009)

Source: U.S. Bureau of Economic Analysis

Research from the American Legislative Exchange Council (ALEC) and Laffer Associates confirms the differing patterns of economic growth. In their 2012 performance rankings (economic growth from 2000-2010) South Dakota, Texas and Colorado ranked 7th, 2nd, and 24th nationally.[2] Meanwhile, Ohio ranked 49th while Michigan followed in 50th place.

From just a glance at the data, the correlation is obvious: States that spend beyond their means do not prosper. Instead, states that foster pro-growth public policies and restrain spending are best able to promote growth. Few measures better demonstrate the relationship between government spending and private sector growth than state and local spending burdens.

1. Matt Mayer., “Six Principles for Fixing Ohio,” The Buckeye Institute for Public Policy Solutions, February 2011, at http://www.buckeyeinstitute.org/uploads/files/BUCKEYE- six-principles-fixing-ohio-1(1).pdf

2. Arthur Laffer et al., “Rich States, Poor States,” American Legislative Exchange Council, April 2011.